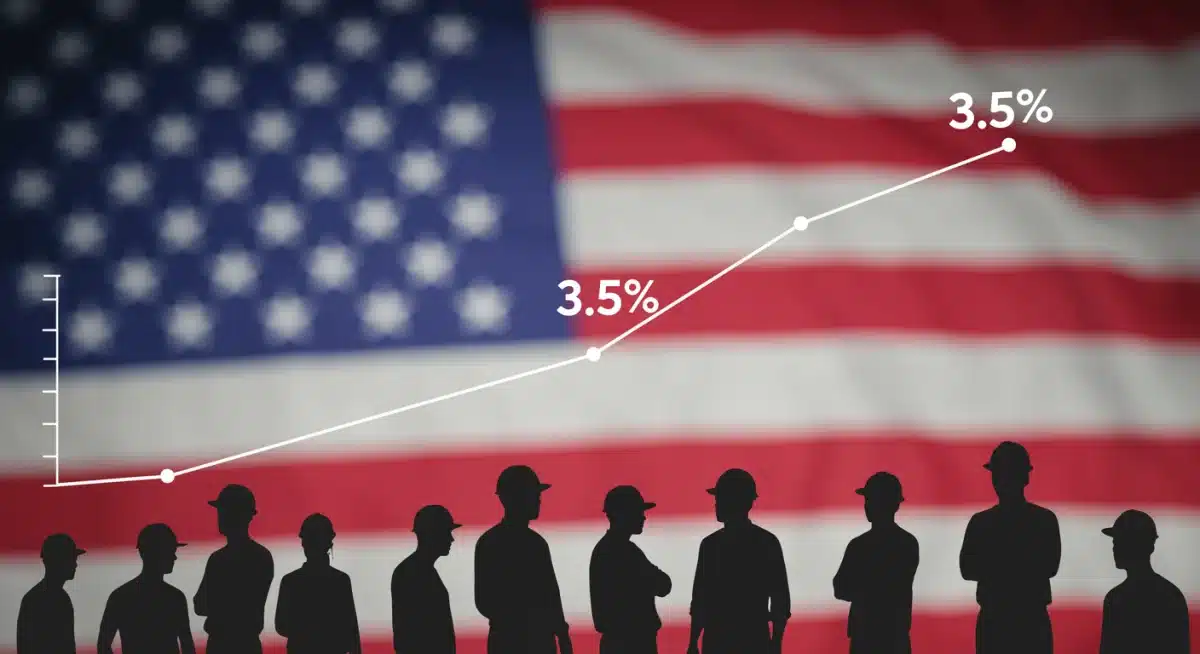

US Unemployment Rate Steady at 3.5% in January 2026

The latest economic figures confirm the US unemployment rate remained consistently at 3.5% in January 2026, indicating a stable labor market amidst evolving economic conditions.

The economy continues to be a central topic of discussion, and recent figures offer a clear snapshot of its current state. New data reveals: Unemployment rate holds steady at 3.5% across the U.S. in January 2026, a figure that resonates across households and financial markets alike. What does this sustained stability mean for you, for businesses, and for the broader economic landscape? Let’s delve into the details and uncover the implications.

Understanding the 3.5% Unemployment Rate

The consistent 3.5% unemployment rate in January 2026 is more than just a number; it’s a critical indicator of economic health. This figure suggests a robust labor market where most individuals seeking employment are finding it, reflecting a balance between labor supply and demand. Such stability often signals confidence among employers and a relatively strong consumer base, which are vital components of a thriving economy.

Historically, a 3.5% unemployment rate is considered exceptionally low, often associated with periods of economic expansion. It implies that the economy is operating near its full potential, with minimal slack in the labor force. This stability can also influence wage growth, as employers may need to offer competitive salaries to attract and retain talent in a tight job market.

What does ‘steady’ truly mean?

When we say the unemployment rate holds steady, it means there hasn’t been a significant month-over-month fluctuation. This consistency is often viewed positively, as it reduces uncertainty and provides a predictable environment for businesses and consumers. A stable rate suggests that any underlying economic shifts are not drastically impacting employment levels.

- Economic Resilience: A steady low rate indicates the economy’s ability to absorb shocks and maintain employment levels.

- Business Confidence: Employers are likely confident in future demand to maintain or slightly increase their workforce.

- Consumer Spending: High employment often translates to higher consumer spending, fueling economic growth.

In essence, a steady 3.5% unemployment rate in January 2026 paints a picture of an economy that, while not rapidly accelerating, is maintaining a strong and dependable foundation. This stability is crucial for long-term planning and investment, both for individuals and corporations, providing a sense of security in an often volatile world.

Factors Contributing to Labor Market Stability

The sustained 3.5% unemployment rate doesn’t happen in a vacuum; it’s the result of several interconnected economic and social factors. Understanding these contributors helps us appreciate the complexity of the labor market and why this particular stability is noteworthy. Policy decisions, technological advancements, and evolving consumer behavior all play significant roles.

One primary factor is the continued adaptation of businesses to post-pandemic realities, leading to optimized operational models and a clearer understanding of workforce needs. This has translated into more strategic hiring and retention efforts, preventing large-scale layoffs that could destabilize the job market. Furthermore, certain sectors have seen sustained growth, absorbing workers and maintaining overall employment levels.

Sectoral growth and innovation

Specific industries have acted as key drivers of employment stability. The technology sector, for instance, continues its relentless pace of innovation, creating new roles and expanding existing ones. Healthcare, driven by demographic shifts and ongoing advancements, remains a consistent source of job opportunities. Manufacturing, too, has seen a resurgence in certain areas, bolstered by investments in automation and reshoring initiatives.

- Technology: High demand for software developers, data scientists, and cybersecurity experts.

- Healthcare: Growing need for nurses, doctors, and allied health professionals due to an aging population.

- Green Energy: Expansion in renewable energy projects creating new jobs in engineering, installation, and maintenance.

Beyond specific sectors, government policies aimed at workforce development and infrastructure spending also contribute. These initiatives can create direct jobs and stimulate economic activity, indirectly supporting employment across various industries. The stability in the unemployment rate reflects a broad-based effort to maintain economic equilibrium.

Impact on Wages and Inflation

The relationship between a low unemployment rate, wage growth, and inflation is a cornerstone of macroeconomic theory. When the labor market is tight, as indicated by a 3.5% unemployment rate, employers often face pressure to increase wages to attract and retain skilled workers. This can have a ripple effect throughout the economy, influencing purchasing power and potentially contributing to inflationary pressures.

In January 2026, the sustained low unemployment rate suggests that wage growth might be continuing at a moderate pace. While beneficial for workers, policymakers often monitor this closely to ensure it doesn’t lead to an unsustainable wage-price spiral. The balance lies in allowing wages to grow enough to improve living standards without igniting excessive inflation that erodes those very gains.

Inflationary concerns remain a key consideration for central banks. An economy with full employment and rising wages can sometimes lead to increased consumer demand, which, if not met by an equivalent increase in supply, drives up prices. However, modern economies are complex, and other factors like global supply chains, energy prices, and fiscal policies also play significant roles in determining inflation.

Navigating the wage-price dynamic

The current scenario presents a delicate balancing act for economic policy. On one hand, sustained employment and wage increases are desirable for individual prosperity. On the other, uncontrolled inflation can undermine economic stability. The Federal Reserve, for instance, will be carefully observing wage data alongside other economic indicators to make informed decisions about interest rates and monetary policy.

- Moderate Wage Growth: Supports consumer purchasing power without triggering aggressive inflation.

- Inflation Targeting: Central bank policies aim to keep inflation within a manageable range.

- Productivity Gains: Increased productivity can offset wage increases, reducing inflationary pressure.

Ultimately, the 3.5% unemployment rate in January 2026 implies a continued focus on ensuring that economic growth is sustainable and that the benefits of a strong labor market are not eroded by unchecked price increases. It’s a testament to ongoing efforts to manage both sides of the economic coin effectively.

Regional Disparities in Employment

While the national unemployment rate provides a crucial overview, it’s essential to remember that economic conditions can vary significantly across different regions of the U.S. A 3.5% national average in January 2026 often masks underlying regional disparities, with some states or metropolitan areas experiencing even lower rates, and others facing higher unemployment challenges.

These differences can be attributed to various factors, including the dominant industries in a particular region, local economic policies, population shifts, and educational attainment levels. For example, areas with a strong presence of growing sectors like technology or specialized manufacturing might boast significantly lower unemployment rates, while regions heavily reliant on declining industries could struggle.

Understanding local labor markets

Analyzing regional data offers a more nuanced understanding of the labor landscape. States with diverse economies, or those that have successfully attracted new businesses, tend to exhibit greater resilience. Conversely, regions experiencing outward migration or a lack of investment in new industries may face persistent employment challenges, even when the national picture looks favorable.

- State-level Differences: Some states consistently outperform the national average, while others lag.

- Urban vs. Rural: Urban centers often have more diverse job markets than rural areas, leading to different employment dynamics.

- Industry Concentration: Regions specializing in a single industry are more susceptible to its boom and bust cycles.

Understanding these regional variations is crucial for policymakers to implement targeted interventions and support programs. A national average, while informative, should always be contextualized by the unique economic realities faced by communities across the country. The 3.5% national rate in January 2026 is a positive sign, but it doesn’t mean every American community is experiencing the same level of prosperity.

Government Policies and Economic Outlook

Government policies play a pivotal role in shaping the economic landscape and, by extension, the unemployment rate. In the context of the sustained 3.5% unemployment rate in January 2026, it’s worth examining how existing and proposed policies might be contributing to this stability and what the future economic outlook holds.

Fiscal policies, such as government spending on infrastructure, tax incentives for businesses, and support for education and training programs, can directly influence job creation and workforce readiness. Monetary policies, primarily managed by the Federal Reserve, impact interest rates and the overall availability of credit, which in turn affects business investment and hiring decisions. The current stable unemployment rate suggests that these policies are, so far, effectively navigating economic complexities.

Future projections and challenges

Looking ahead, economists will be closely watching several factors that could influence the labor market. Geopolitical events, global economic trends, and domestic policy shifts could all impact the trajectory of employment. The ongoing stability of the 3.5% unemployment rate in January 2026 provides a strong foundation, but it doesn’t guarantee future immunity from potential downturns or shifts.

- Fiscal Stimulus: Continued government investment could sustain job growth.

- Monetary Policy: Interest rate adjustments by the Federal Reserve will be critical for managing inflation and growth.

- Global Economy: International trade and economic conditions can indirectly affect domestic employment.

The economic outlook remains cautiously optimistic, with the low unemployment rate being a key strength. However, challenges such as potential labor shortages in specific skilled trades, the impact of artificial intelligence on certain job categories, and the need for continuous workforce reskilling will require proactive policy responses to maintain this stability in the long term.

The Role of Workforce Development and Education

The sustained low unemployment rate of 3.5% in January 2026 underscores the critical importance of a skilled and adaptable workforce. In an economy that is constantly evolving, driven by technological advancements and changing industry demands, investment in workforce development and education becomes paramount. This ensures that individuals have the necessary skills to fill available jobs and that the labor market remains dynamic and competitive.

Educational institutions, from vocational schools to universities, play a vital role in preparing the next generation of workers. Simultaneously, ongoing training and reskilling programs are essential for existing employees to adapt to new technologies and job requirements. Without a concerted effort in these areas, even a low unemployment rate could mask skill gaps that hinder economic growth and leave certain segments of the population behind.

Bridging the skills gap

A significant challenge in a tight labor market like the one indicated by the 3.5% unemployment rate is the potential for skill gaps. Employers may struggle to find candidates with the specific expertise needed for specialized roles, even as other sectors experience labor surpluses. This highlights the need for targeted training initiatives that align with current and future industry demands.

- Vocational Training: Essential for trades and technical skills in high demand.

- Higher Education: Provides foundational knowledge and specialized degrees for professional roles.

- Lifelong Learning: Continuous education and reskilling crucial for adapting to a changing job market.

Collaborations between government, businesses, and educational institutions are key to addressing these challenges effectively. Apprenticeship programs, industry-specific certifications, and employer-sponsored training initiatives can help bridge the gap between available talent and employer needs, ensuring that the low unemployment rate translates into meaningful and sustainable employment opportunities for all.

Looking Ahead: What to Expect in the Coming Months

The stability of the 3.5% unemployment rate in January 2026 provides a solid benchmark for economic expectations in the near future. While no economic forecast is foolproof, this consistent figure allows for informed predictions about the trajectory of the U.S. labor market and broader economic performance. Economic indicators suggest a continued period of moderate growth, but with an ever-watchful eye on emerging trends.

Analysts will be focusing on several key data points in the coming months, including job creation numbers, wage growth specifics, and inflation readings. Any significant deviation from these trends could signal a shift in the economic landscape. The current stability suggests that major policy changes or external shocks would be required to significantly alter the employment picture in the short term.

Potential headwinds and tailwinds

While the outlook is generally positive, there are always potential factors that could either boost or hinder economic performance. Tailwinds might include increased business investment due to improved confidence, greater consumer spending, or favorable global trade conditions. Conversely, headwinds could arise from unforeseen supply chain disruptions, a slowdown in global growth, or domestic policy uncertainties.

- Consumer Confidence: A key indicator for future spending and economic activity.

- Business Investment: New capital expenditures can lead to job creation.

- Global Economic Health: Impacts demand for U.S. exports and international supply chains.

The sustained 3.5% unemployment rate in January 2026 reinforces the idea that the U.S. economy possesses considerable resilience. However, continuous monitoring of economic data and adaptive policy-making will be essential to navigate the complexities of the global economy and ensure continued prosperity in the months that follow. The labor market’s steady performance is a strong foundation upon which future growth can be built.

| Key Point | Brief Description |

|---|---|

| Unemployment Rate | Held steady at 3.5% in January 2026, indicating a stable and robust labor market. |

| Economic Implications | Suggests strong economic resilience, business confidence, and potentially moderate wage growth. |

| Key Contributing Factors | Sectoral growth (tech, healthcare), government policies, and workforce development initiatives. |

| Future Outlook | Cautiously optimistic, with continued monitoring of inflation, global trends, and skill gaps. |

Frequently Asked Questions About the Unemployment Rate

A 3.5% unemployment rate indicates a very strong and stable labor market, suggesting that most people seeking jobs are finding them. This typically points to a healthy economy with robust business activity and consumer confidence, operating near full employment capacity.

Historically, a 3.5% unemployment rate is considered exceptionally low. Over the past several decades, the average unemployment rate has often hovered between 5-6%. This current figure places the U.S. labor market in a strong position relative to its long-term performance.

A low unemployment rate can contribute to inflationary pressures as employers may increase wages to attract workers, leading to higher consumer spending. However, inflation is also influenced by other factors like supply chain dynamics, energy costs, and monetary policy, making it a complex interaction.

Key sectors contributing to the stable unemployment rate typically include technology, healthcare, and professional services. These industries often demonstrate consistent growth and demand for skilled labor, acting as significant drivers of overall employment stability across the nation.

A stable, low unemployment rate provides the Federal Reserve with flexibility regarding interest rate decisions. While it might suggest less need for aggressive rate cuts to stimulate employment, the Fed will also consider inflation and broader economic growth when setting monetary policy.

Conclusion

The announcement that the US unemployment rate holds steady at 3.5% in January 2026 offers a reassuring picture of the nation’s economic health. This consistent figure signifies a resilient labor market, driven by growth in key sectors and supported by strategic government policies and ongoing workforce development efforts. While regional disparities and inflationary pressures remain areas of vigilant observation, the current stability provides a strong foundation for continued economic confidence. As we move forward, careful monitoring of global trends and adaptive policy-making will be crucial to sustain this positive trajectory and ensure broad-based prosperity across the United States.