Unclaimed Benefits US: Your 3-Step Guide to Recovering Government Aid

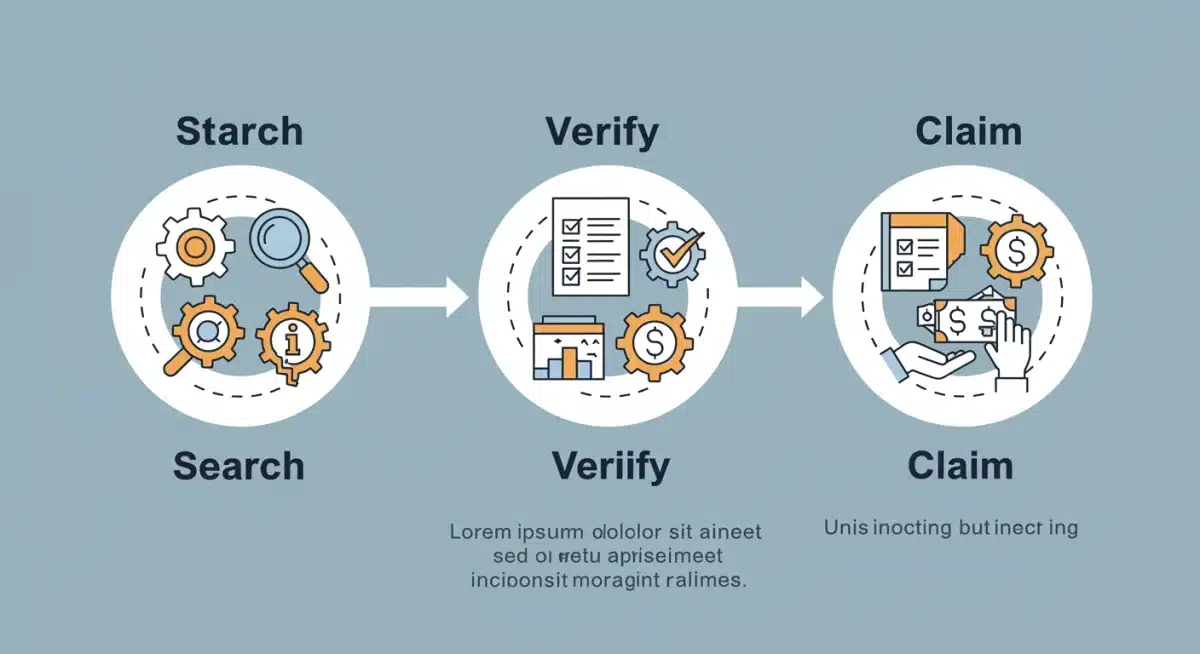

This guide outlines a practical 3-step process for US residents to effectively locate and claim their rightful government benefits and overlooked financial aid, ensuring they recover funds and maximize their financial well-being.

Have you ever wondered if there’s money or benefits out there with your name on them, just waiting to be claimed? In the United States, billions of dollars in various forms of aid and assets go unclaimed every year. This article provides a comprehensive, unclaimed benefits US 3-step guide to help you navigate the process of identifying and recovering overlooked government aid, potentially unlocking significant financial impact for you and your family.

Understanding the Landscape of Unclaimed Benefits

Before diving into the recovery process, it’s crucial to understand what constitutes “unclaimed benefits” and why they exist. These aren’t just forgotten bank accounts; they encompass a wide array of financial assets and government aid programs that, for various reasons, have not reached their intended recipients.

The reasons for these unclaimed funds are diverse. Sometimes, it’s due to a change of address, forgotten deposits, or simply a lack of awareness about available programs. From state-held property to federal grants, the pool of unclaimed assets is vast and often surprising. Many people are unaware that they might be entitled to funds from past employers, insurance policies, or even utility deposits.

Types of Unclaimed Government Aid

Government aid can take many forms, extending beyond the typical unemployment or social security benefits. Understanding the different categories is the first step in knowing where to look.

- State Unclaimed Property Programs: These often hold forgotten bank accounts, uncashed checks, security deposits, and contents of safe deposit boxes. Every state has its own program to reunite citizens with their assets.

- Federal Benefits: This can include veteran benefits, tax refunds, pension funds, and even certain types of insurance payouts that were never distributed.

- Insurance Payouts: Life insurance policies or forgotten annuities where beneficiaries were never notified or couldn’t be located.

- Pension Funds: Unclaimed pension benefits from former employers, especially if a company has merged, been acquired, or gone out of business.

These various types highlight the complexity and breadth of the issue. Many individuals are simply unaware they are owed money, making the search process both challenging and potentially rewarding. The sheer volume of these unclaimed assets underscores the importance of proactive searching.

In essence, unclaimed benefits represent a significant financial opportunity for many Americans. By grasping the scope of these funds and their origins, individuals can approach the recovery process with a clearer understanding and greater purpose. This foundational knowledge sets the stage for the practical steps to follow, ensuring a more effective and targeted search.

Step 1: Initiating Your Search: Where to Look First

The journey to recovering your unclaimed benefits begins with a systematic and thorough search. With numerous databases and government agencies involved, knowing where to start can save you a significant amount of time and effort. This initial step is critical for casting a wide net and identifying potential sources of overlooked aid.

It’s important to approach this step with patience and attention to detail. Many resources are available online, making the initial search relatively straightforward. However, the sheer volume of information can be overwhelming without a clear strategy. Start by focusing on official government websites, as these are the most reliable sources for locating legitimate unclaimed funds.

Key Online Resources for Unclaimed Funds

Several primary platforms serve as central hubs for locating unclaimed property and benefits. Familiarizing yourself with these resources is paramount.

- MissingMoney.com: This is a free, national database endorsed by NAUPA (National Association of Unclaimed Property Administrators). It allows you to search for unclaimed property across many states simultaneously.

- State Unclaimed Property Websites: Each state maintains its own unclaimed property division. If MissingMoney.com doesn’t cover your state or you want a more direct approach, visit the official website for any state where you or your family members have lived, worked, or done business.

- US Department of the Treasury: For federal tax refunds that have gone uncashed, the IRS provides information on its website. Similarly, other federal agencies might hold funds related to specific programs.

Beyond these, consider specialized databases. For instance, the Pension Benefit Guaranty Corporation (PBGC) offers a search tool for unclaimed pension benefits. For veterans, the Department of Veterans Affairs (VA) website is the go-to resource for any unclaimed benefits related to service.

When conducting your search, use various spellings of your name, including maiden names or previous names. Also, search for close relatives, as you might be the rightful heir to their unclaimed assets. This comprehensive approach ensures you don’t miss any potential leads. Remember, legitimate sites will never ask for payment to reveal whether you have unclaimed property.

The initial search is about discovery. It’s about gathering as much information as possible to determine where your potential unclaimed benefits might reside. By diligently exploring these resources, you lay the groundwork for the subsequent verification and claiming stages, bringing you closer to recovering what’s rightfully yours.

Step 2: Verifying Your Claim and Gathering Documentation

Once you’ve identified potential unclaimed benefits, the next critical step is to verify your claim and compile the necessary documentation. This stage is where you transition from discovery to proving your entitlement to the funds. Accuracy and completeness in your documentation are key to a smooth and successful claim process.

Each type of unclaimed benefit will likely require specific forms of proof. It’s not a one-size-fits-all process. Therefore, carefully review the requirements outlined by the respective agency or state unclaimed property division. Rushing this step or providing incomplete information can lead to delays or even rejection of your claim.

Essential Documents for Claim Verification

While requirements vary, several common documents are frequently requested to verify your identity and connection to the unclaimed property.

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is almost always required.

- Proof of Residency: Utility bills, bank statements, or other official mail showing your address at the time the property became unclaimed.

- Proof of Relationship: If claiming on behalf of a deceased relative, you’ll need a death certificate, will, or other legal documents proving your relationship and right to inherit.

- Original Documentation: For certain items, like uncashed checks or old stock certificates, the original document might be requested.

It’s advisable to gather these documents proactively. Even if not explicitly requested initially, having them ready can expedite the process if they become necessary. Make copies of everything you send and keep detailed records of all correspondence, including dates, names of contacts, and reference numbers.

Additionally, be prepared to answer questions about the nature of the unclaimed property. For example, if it’s a forgotten bank account, you might need to provide details about the bank, account number, or approximate balance. The more information you can provide, the stronger your claim will be. Trustworthy agencies will never ask for your bank account details or social security number via unsolicited emails or calls for verification purposes.

Verifying your claim is about building a compelling case for your entitlement. By meticulously gathering and organizing all required documentation, you significantly increase your chances of a successful recovery. This careful preparation minimizes potential roadblocks and ensures that your hard work in identifying the funds doesn’t go to waste.

Step 3: Submitting Your Claim and Following Up

With your potential unclaimed benefits identified and all necessary documentation in hand, the final step is to formally submit your claim and diligently follow up on its progress. This stage requires attention to detail in submission and persistence in tracking, as the processing times can vary significantly.

Each agency or state unclaimed property division will have its specific submission procedures. Some may allow online submission, while others require physical mail. Adhering strictly to these instructions is crucial to avoid any technical rejections or delays. Double-check all forms for accuracy and ensure all required fields are completed before submission.

Navigating the Claim Submission Process

The submission process, while seemingly straightforward, can have nuances depending on the type of benefit and the administering entity.

- Online Portals: Many state unclaimed property divisions offer secure online portals for claim submission. This is often the fastest method.

- Mail Submission: For some federal benefits or more complex state claims, you might need to print forms, attach copies of documents, and mail them to the designated address. Always use certified mail with a return receipt for important documents.

- In-Person Submission: In rare cases, or for very specific types of claims, an in-person visit to a local office might be required or advisable.

After submission, patience is key, but so is proactive follow-up. Most agencies will provide an estimated processing time. If this period passes without an update, don’t hesitate to inquire about the status of your claim. Keep a log of all communications, including dates, names of representatives, and any reference numbers provided.

Be prepared for potential requests for additional information. It’s not uncommon for agencies to ask for further clarification or documentation during their review process. Responding promptly and thoroughly to these requests will help keep your claim moving forward. If your claim is denied, understand the reasons for the denial and explore options for appeal, if available.

Successfully claiming your unclaimed benefits US is a testament to perseverance. By meticulously following the submission guidelines and maintaining consistent follow-up, you significantly increase the likelihood of recovering your overlooked government aid. This final stage is where your efforts culminate in tangible financial recovery.

Common Pitfalls and How to Avoid Them

While the process of claiming unclaimed benefits is generally straightforward, there are several common pitfalls that can delay or even derail your efforts. Being aware of these potential issues can help you navigate the process more smoothly and increase your chances of success.

One of the most frequent mistakes is falling victim to scams. Unfortunately, the existence of unclaimed funds attracts fraudulent schemes. Legitimate government agencies and unclaimed property divisions will never ask for an upfront fee to release your funds. Be wary of any communication that requests payment or sensitive personal information via unsecured channels.

Avoiding Delays and Fraud

Proactive steps can significantly mitigate the risks and streamline your claim.

- Verify Sources: Always ensure you are on an official government website (look for .gov domains) or a reputable, NAUPA-endorsed site like MissingMoney.com.

- Beware of Fees: Legitimate services for finding unclaimed property are typically free. If a third party charges a fee, ensure they are reputable and that their fee structure is transparent and reasonable, often a percentage of recovered funds only after success.

- Keep Records: Maintain meticulous records of all searches, claims, and communications. This is invaluable if a dispute arises or if you need to re-submit information.

- Be Patient but Persistent: Understand that processing times can be long. While patience is necessary, don’t confuse it with inaction. Follow up regularly as per the agency’s guidelines.

Another common issue is providing incomplete or inaccurate documentation. This often leads to requests for additional information, delaying the process. Before submitting, cross-reference all required documents against what you have compiled. Ensure names, addresses, and dates match across all submitted materials.

Furthermore, some individuals give up too soon. The process can be tedious, and sometimes initial searches yield no results. However, new unclaimed property is added to databases regularly, so periodic re-checks are advisable, especially if you’ve moved or changed names. Avoiding these common pitfalls means approaching the task with diligence and a healthy dose of skepticism towards anything that seems too good to be true.

Maximizing Your Financial Impact: Beyond Recovery

Recovering unclaimed benefits US is more than just getting back forgotten money; it’s an opportunity to re-evaluate and potentially enhance your financial standing. The funds recovered can have a significant impact, whether used for immediate needs, debt reduction, or long-term investments. This section explores how to make the most of your recovered assets.

Once you successfully claim your funds, consider the best way to integrate them into your financial plan. For some, it might mean paying off high-interest debt, providing immediate relief and improving credit scores. For others, it could be an unexpected boost to savings or an investment opportunity. The key is to have a clear strategy rather than simply spending the newfound money impulsively.

Strategic Use of Recovered Funds

Thinking strategically about how to utilize your recovered assets can amplify their positive effects.

- Debt Reduction: Prioritize paying down high-interest credit card debt or personal loans to save money on interest payments over time.

- Emergency Fund: Boost or establish an emergency savings fund to provide a financial cushion for unexpected expenses, reducing future financial stress.

- Investments: Consider investing the funds in a retirement account (e.g., IRA, 401k) or a diversified investment portfolio for long-term growth.

- Education or Home Improvement: Use the funds for educational expenses, home repairs, or improvements that add value to your property.

Beyond the immediate financial injection, the process of searching for and recovering unclaimed benefits can also serve as a valuable lesson in financial vigilance. It encourages individuals to be more diligent about tracking their assets, updating contact information with financial institutions, and regularly reviewing their financial statements.

Moreover, consider setting up a system for periodic checks for unclaimed property. Given that new funds are added regularly, making this a yearly or bi-yearly habit can ensure you don’t miss out on future entitlements. Maximizing the financial impact extends beyond the initial recovery; it involves thoughtful planning and ongoing vigilance to secure your financial future.

The Broader Implications of Unclaimed Government Aid

The phenomenon of unclaimed government aid and forgotten assets has broader implications beyond individual financial recovery. It sheds light on systemic challenges in communication, financial literacy, and the sheer complexity of modern financial systems. Understanding these larger contexts can help us appreciate the scale of the issue and the importance of accessible recovery processes.

Billions of dollars sitting in state and federal coffers represent not just lost individual wealth but also a significant amount of capital that could be circulating within the economy. These funds, if returned to their rightful owners, could stimulate local economies, support personal investments, and alleviate financial burdens for countless families. The challenge lies in efficiently connecting these funds with their owners.

Systemic Challenges and Solutions

Addressing the issue of unclaimed benefits requires a multi-faceted approach, involving both government initiatives and individual responsibility.

- Improved Outreach: Government agencies could enhance public awareness campaigns to inform citizens about the existence of unclaimed property and how to search for it.

- Simplified Processes: Streamlining the claim process across different states and federal agencies could make it easier for individuals to recover their funds.

- Financial Education: Promoting financial literacy can empower individuals to better track their assets and understand their entitlements, reducing the likelihood of funds becoming unclaimed.

- Technological Integration: Utilizing advanced data analytics and interoperable databases could help proactively match unclaimed funds with their owners.

The existence of unclaimed benefits also underscores the dynamic nature of personal finances. Life events such as moving, marriage, divorce, or the passing of a loved one can easily lead to assets being overlooked. Financial institutions and employers also bear a responsibility to maintain accurate records and make diligent efforts to contact account holders.

Ultimately, the effort to recover unclaimed benefits US is a collaborative one. While individuals must take the initiative to search and claim, government bodies and financial institutions play a crucial role in facilitating this process. By working together, we can reduce the volume of unclaimed assets and ensure that financial resources reach those for whom they are intended, fostering greater financial stability and equity across the nation.

| Key Step | Brief Description |

|---|---|

| Search | Utilize official state and federal databases like MissingMoney.com to identify potential unclaimed funds. |

| Verify | Gather necessary documentation (ID, proof of residency, relationship) to prove your entitlement to the funds. |

| Claim & Follow Up | Submit your claim through the proper channels and diligently track its progress until recovery. |

Frequently Asked Questions About Unclaimed Benefits

Unclaimed benefits are financial assets or government aid that have not been claimed by their rightful owners. This can include forgotten bank accounts, uncashed checks, utility deposits, insurance payouts, pension funds, and even federal tax refunds held by various state and federal agencies.

Begin your search using official government resources. MissingMoney.com is a good starting point for state-held property across multiple states. Also, check individual state unclaimed property websites and federal agency sites like the IRS or PBGC for specific federal benefits.

No, legitimate government services for searching and claiming unclaimed property are always free. Be cautious of any website or service that asks for an upfront fee to reveal or process your claim, as these are often scams.

Commonly required documents include proof of identity (driver’s license, passport), proof of residency (utility bills), and sometimes proof of relationship if claiming for a deceased person (death certificate, will). Specific requirements vary by state and type of claim.

Processing times can vary significantly, ranging from a few weeks to several months, depending on the agency, the complexity of the claim, and the volume of submissions. Consistent follow-up and prompt responses to requests for information can help expedite the process.

Conclusion

The journey to recovering unclaimed benefits US may seem daunting at first, but with a structured approach, it is an entirely achievable goal. Billions of dollars remain overlooked, representing a tangible financial opportunity for countless Americans. By following the three essential steps outlined – initiating a thorough search, meticulously verifying your claim with proper documentation, and diligently submitting and following up – you significantly increase your chances of reuniting with your rightful assets. This process not only offers a direct financial boost but also instills greater financial awareness, encouraging a proactive stance towards managing personal wealth. Embrace this guide as your roadmap to unlocking overlooked government aid and securing a more robust financial future.