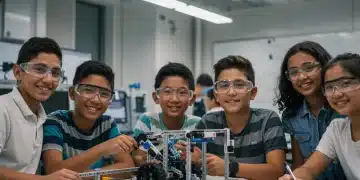

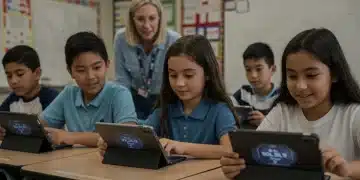

AI in US K-12 Education: 3 Key Trends for 2025

AI is rapidly reshaping US K-12 education, driving personalized learning experiences, streamlining administrative tasks, and fostering essential new skills for students by 2025.

Social Security Disability: Expedite Your Claim in 2025

This guide provides a comprehensive 6-step plan to expedite your Social Security Disability claim in 2025, offering practical solutions to minimize delays and improve your chances of approval.

Education Reform: Congressional Bill Reworks Student Loans by 2025

A significant congressional bill introduced in November 2024 aims to rework student loan policies by 2025, promising widespread changes for borrowers and the future of higher education financing in the United States.

Maximize Your 401(k) to $23,000 for 2025 Retirement Planning

Maximizing your 401(k) contributions to the 2025 limit of $23,000 is a cornerstone of effective retirement planning, offering significant tax advantages and compounding growth for a secure financial future.

Boost Reading Scores by 15% in 6 Months: US Strategies

This article outlines effective, research-backed US education strategies designed to significantly boost a child's reading scores by 15% within a six-month timeframe, offering practical guidance for parents and educators.

Child Care Assistance 2025: Secure Up to $1,200 Annually

Understanding and acting on 2025 child care assistance deadlines is crucial for families seeking financial relief, as timely applications can secure up to $1,200 annually to offset significant child care costs.