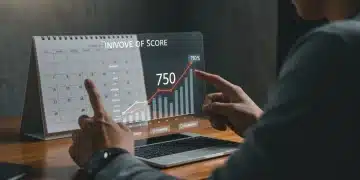

Credit Score Maximization 2026: Reach 750+ in 6 Months

Achieving a high credit score is crucial for financial well-being. This guide provides 7 expert tips for credit score maximization in 2026, enabling you to reach a score above 750 within six months through strategic financial practices.

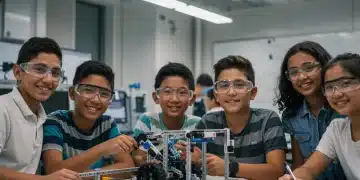

Future-Proof Your Career: Top 5 Certifications for US Jobs in 2026

To future-proof your career in the rapidly evolving US job market by 2026, focusing on strategic certifications in high-growth sectors like AI, cybersecurity, and cloud computing is paramount for sustained professional relevance.

Child Tax Credit 2026: Boost Family Income by $500 Annually

The Child Tax Credit (CTC) in 2026 is poised to offer significant financial relief to American families, potentially boosting annual income by $500 through key policy adjustments aimed at enhancing support for children.

Infrastructure Bill Updates: Reshaping U.S. Transportation for 5 Years

Major infrastructure bill updates are poised to significantly reshape U.S. transportation projects over the next five years, channeling substantial federal investment into critical upgrades for roads, bridges, public transit, and other essential systems nationwide, driving economic growth and modernizing crucial networks.

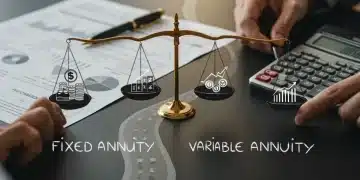

Understanding Annuities in 2026: Fixed vs. Variable Retirement Options

Comparing fixed and variable annuities in 2026 is crucial for securing retirement income, offering distinct paths for growth and stability to align with diverse financial goals.

2026 Medicare Part B Premium Adjustments: What You Need to Know

Understanding the 2026 Medicare Part B premium adjustments is crucial for beneficiaries to anticipate healthcare costs. This guide explores the factors driving these changes and offers insights into navigating potential financial impacts on your Medicare benefits.