ACP Status Update: Critical 2026 Internet Subsidy Deadlines

The Affordable Connectivity Program (ACP) faces critical deadlines in 2026, impacting internet subsidies for millions of eligible households. Understanding these dates is crucial for continued affordable internet access.

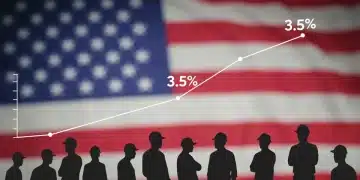

US Unemployment Rate Steady at 3.5% in January 2026

New data confirms the US unemployment rate remained stable at 3.5% in January 2026, signaling a resilient job market and offering insights into broader economic trends and future projections for American workers.

Inflation Outlook 2026: Budgeting for a 3% Living Cost Increase

The 2026 inflation outlook suggests a projected 3% increase in living costs, necessitating proactive budget adjustments and strategic financial planning to safeguard purchasing power and ensure economic stability for households across the United States.

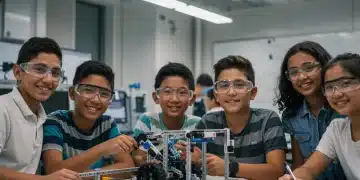

K-12 Curriculum Standards 2026: Parent Overview & Updates

The new 2026 K-12 Curriculum Standards introduce significant changes to U.S. education, focusing on personalized learning, digital literacy, and holistic development to better prepare students for future challenges.

Unemployment Benefits 2026: Claiming Your 26 Weeks Support

This guide provides essential information on navigating unemployment benefits in 2026, offering a clear, step-by-step approach to understanding eligibility, application processes, and how to claim up to 26 weeks of crucial financial support.

Supply Chain Disruptions Affect 60% of US Retailers by 2026

Recent data reveals that 60% of U.S. retailers are grappling with significant challenges stemming from ongoing supply chain disruptions in early 2026, impacting inventory, pricing, and consumer satisfaction.