Debt Management: Reducing Credit Card Interest by 10% in 2025

Effectively managing credit card debt in 2025 involves strategic approaches like balance transfers, which can significantly reduce interest rates and accelerate repayment, leading to greater financial stability.

Are you burdened by high credit card interest rates? Understanding effective debt management strategies, particularly focusing on balance transfers, can be a game-changer for your financial health in 2025. This article delves into how you can potentially reduce your credit card interest by 10% or more, paving the way for a more secure financial future.

Understanding the Landscape of Credit Card Debt in 2025

The financial landscape is ever-evolving, and 2025 presents both challenges and opportunities for individuals grappling with credit card debt. High-interest rates can feel like an insurmountable hurdle, making it difficult to make significant progress on reducing your principal balance. Many consumers find themselves paying substantial amounts each month, with a large portion going directly to interest, rather than reducing the actual debt.

This cycle of high interest payments can be incredibly frustrating and demotivating. It’s crucial to acknowledge that you are not alone in this struggle. Millions of Americans face similar challenges, often due to unexpected expenses, economic shifts, or simply the compounding effect of interest over time. Recognizing the problem is the first step toward finding a viable solution. By understanding the current economic climate and how it impacts credit card interest, you can better prepare to implement effective debt management strategies.

The Impact of High Interest Rates

- Slower Debt Repayment: A significant portion of your monthly payment goes to interest, leaving less to pay down the principal.

- Increased Overall Cost: Over time, high interest rates drastically increase the total amount you pay for your purchases.

- Financial Stress: The constant pressure of high payments and slow progress can lead to considerable financial anxiety.

In 2025, with potential fluctuations in economic indicators, proactive debt management is more important than ever. Relying solely on minimum payments is often a recipe for prolonged debt. Instead, a targeted approach, such as exploring balance transfer options, can empower you to take control and make real headway against your credit card balances. This foundational understanding sets the stage for exploring specific tactics that can yield tangible results.

The Power of Balance Transfers: A Core Debt Management Strategy

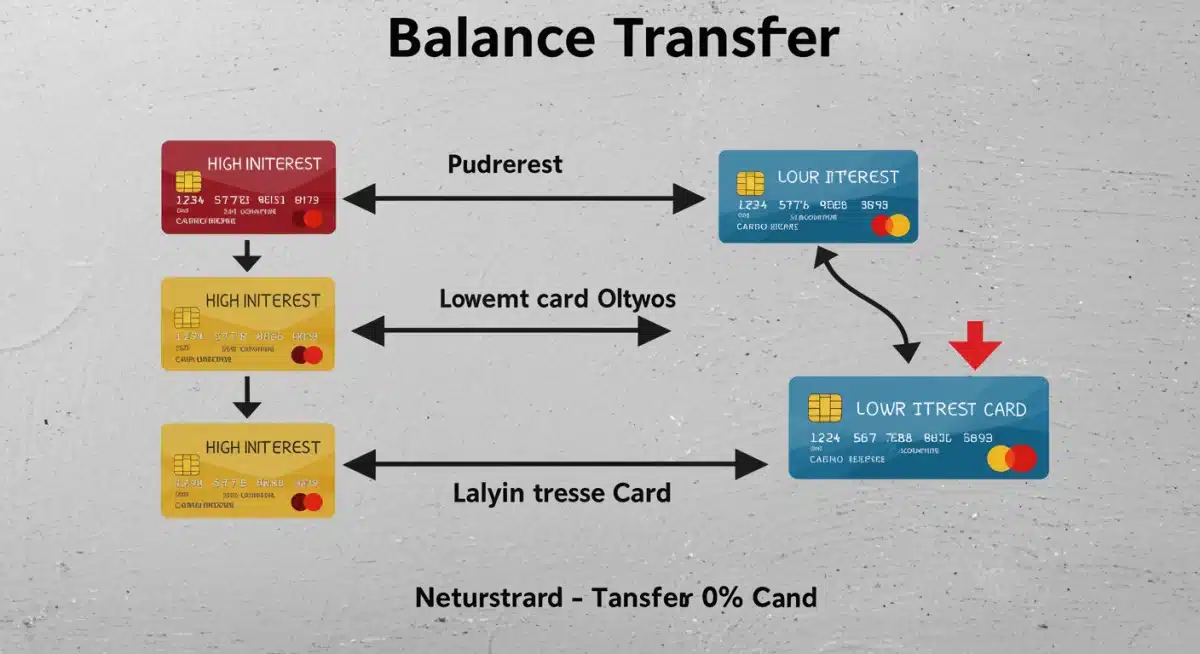

A balance transfer is a powerful financial tool that allows you to move debt from one or more high-interest credit cards to a new card, typically offering a promotional 0% or low-interest APR for an introductory period. This strategy can be incredibly effective in reducing the amount of interest you pay, thereby freeing up more of your payments to go towards the principal balance. It’s a strategic move designed to give you a much-needed reprieve from compounding interest, allowing you to accelerate your debt repayment journey.

The primary benefit of a balance transfer is the opportunity to pay down your debt without the burden of accumulating interest during the promotional period. This window, which can range from 6 to 21 months, is critical. It provides a clear timeline during which every dollar you pay contributes directly to shrinking your debt, rather than just covering interest charges. However, it’s essential to approach balance transfers with a clear plan and a full understanding of the terms and conditions involved.

While the allure of 0% APR is strong, most balance transfer cards come with a balance transfer fee, typically ranging from 3% to 5% of the amount transferred. This fee should be factored into your calculations to ensure the balance transfer remains a financially advantageous move. Despite this fee, the potential savings from avoiding high interest rates often far outweigh the initial cost, especially for larger balances.

Key Benefits of a Balance Transfer

- Significant Interest Savings: Eliminate or drastically reduce interest payments for a set period.

- Streamlined Payments: Consolidate multiple debts into a single, manageable monthly payment.

- Faster Debt Repayment: More of your payments go towards the principal, accelerating your path to debt freedom.

For those committed to aggressively paying down debt, a balance transfer can be a cornerstone of their debt management plan. It offers a structured approach to tackling high-interest credit card debt, providing both immediate relief and a clear pathway to financial freedom. By carefully selecting the right card and maintaining disciplined payments, consumers can effectively harness the power of this strategy.

Identifying the Right Balance Transfer Offers for 2025

Choosing the ideal balance transfer card in 2025 requires careful consideration of various factors to maximize your savings and avoid potential pitfalls. Not all balance transfer offers are created equal, and what might be suitable for one individual may not be the best option for another. Your credit score, the amount of debt you wish to transfer, and your repayment timeline all play significant roles in determining the best fit.

Start by evaluating your credit score. Lenders typically reserve the most attractive 0% APR balance transfer offers for applicants with good to excellent credit. If your score is lower, you might still qualify for a low-interest introductory rate, but the 0% options may be limited. It’s always a good idea to check your credit score before applying, as this will give you a realistic understanding of the offers you’re likely to receive.

Factors to Consider When Choosing a Card

- Introductory APR Period: Look for the longest 0% or low-interest period possible to give yourself ample time to pay down the balance.

- Balance Transfer Fee: Compare fees (typically 3-5% of the transferred amount) and calculate if the interest savings outweigh this initial cost.

- Post-Promotional APR: Understand what the interest rate will be once the introductory period ends, in case you don’t pay off the full balance.

- Credit Limit: Ensure the new card’s credit limit is sufficient to cover the balance you intend to transfer.

Beyond these immediate factors, also consider any additional perks or drawbacks of the card. Some cards offer rewards programs, while others might have annual fees. While rewards can be enticing, the primary goal of a balance transfer card is debt reduction, so prioritize favorable interest rates and fees. By thoroughly researching and comparing different offers, you can identify the balance transfer card that best aligns with your financial goals for 2025, setting the stage for successful debt reduction.

Strategies for Maximizing Your 0% APR Period

Once you’ve secured a balance transfer card with a promotional 0% APR, the real work begins: aggressively paying down your debt before the introductory period expires. This phase is crucial, as failing to pay off the transferred balance within the promotional window can result in significant interest charges on the remaining balance, negating much of the benefit. Developing a solid repayment strategy is paramount to maximizing this opportunity.

The first step is to create a detailed budget. Understand your income and expenses to identify how much you can realistically allocate to your credit card payments each month. Prioritize paying more than the minimum payment, aiming to pay off the entire transferred balance before the 0% APR period ends. Even small additional payments can make a substantial difference over time, especially when no interest is accruing.

Effective Repayment Tactics

Automate Your Payments

Setting up automatic payments for at least the minimum amount ensures you never miss a payment, which could jeopardize your promotional APR. Ideally, set up automatic payments for a higher amount that aligns with your goal of paying off the debt within the introductory period.

Avoid New Purchases

Resist the temptation to use your new balance transfer card for new purchases. Many balance transfer cards apply payments to the lowest APR balance first, meaning new purchases (which typically accrue interest immediately) might be ignored while you’re paying down the 0% APR transferred balance. This can lead to unexpected interest charges on your new spending.

Track Your Progress

Regularly monitor your balance and how much time remains in your promotional period. This will help you stay motivated and adjust your payment strategy if needed. Seeing your balance decrease without additional interest charges can be a powerful motivator.

By diligently adhering to these strategies, you can effectively leverage the 0% APR period to significantly reduce your credit card debt. This focused approach is a cornerstone of effective debt management strategies, allowing you to make substantial progress toward financial freedom in 2025.

Potential Pitfalls and How to Avoid Them

While balance transfers can be a highly effective debt management tool, they are not without potential pitfalls. Understanding and actively avoiding these common mistakes is crucial to ensure that this strategy genuinely benefits your financial situation rather than exacerbating it. Many individuals fall into traps that can undermine their efforts, leading to more debt or unexpected costs.

One of the most common mistakes is failing to pay off the balance before the promotional APR expires. Once the 0% or low-interest period ends, the remaining balance will revert to a much higher, standard APR, which can be just as high, if not higher, than your original card’s rate. This can quickly undo all the progress you’ve made, leaving you in a similar or worse position than before the transfer.

Common Balance Transfer Traps

- Missing Payments: A single late payment can often revoke your promotional APR, immediately applying the higher standard rate.

- New Spending on the Transfer Card: Using the card for new purchases can complicate repayment and lead to interest charges on those new transactions.

- Ignoring the Balance Transfer Fee: While often worth it, forgetting to factor this fee into your total cost can lead to unpleasant surprises.

- Transferring Too Much Debt: Overloading a new card with more debt than you can realistically pay off in the promotional period can be self-defeating.

Another significant pitfall is not addressing the root cause of your debt. If you transfer balances but continue to spend beyond your means on other credit cards, you’ll simply accumulate new debt while trying to pay off the old. A balance transfer should be part of a broader financial overhaul that includes budgeting, responsible spending habits, and potentially building an emergency fund. By being aware of these potential issues and proactively planning to avoid them, you can ensure your balance transfer is a successful component of your overall debt management strategies for 2025.

Beyond Balance Transfers: Holistic Debt Management for 2025

While balance transfers are a powerful tool for reducing credit card interest, they are just one component of a comprehensive approach to debt management. For truly sustainable financial health in 2025, it’s essential to adopt a holistic strategy that addresses not only the symptoms of debt but also its underlying causes. This means developing strong financial habits, exploring other debt reduction methods, and building a resilient financial foundation.

One critical aspect is creating and sticking to a realistic budget. A budget helps you understand where your money is going, identify areas for savings, and allocate funds strategically towards debt repayment. Without a clear picture of your cash flow, even the most effective balance transfer might only offer temporary relief. Regularly reviewing and adjusting your budget is key to its long-term success.

Complementary Debt Reduction Methods

Debt Snowball or Avalanche Method

These methods involve prioritizing debt repayment. The snowball method focuses on paying off the smallest debts first for psychological wins, while the avalanche method prioritizes debts with the highest interest rates to save money over time.

Debt Consolidation Loans

For individuals with substantial debt across multiple accounts, a personal loan for debt consolidation can offer a single, lower-interest monthly payment. This simplifies repayment and can lead to significant interest savings.

Credit Counseling

If you feel overwhelmed, non-profit credit counseling agencies can provide personalized advice, help you create a budget, and sometimes negotiate with creditors on your behalf for more favorable terms.

Ultimately, sustainable debt management is about more than just moving balances; it’s about transforming your relationship with money. By combining strategic tools like balance transfers with consistent budgeting, disciplined spending, and exploring other supportive resources, you can build a robust financial plan for 2025 and beyond. This comprehensive approach ensures that once your debt is under control, it stays that way, fostering long-term financial security and peace of mind.

| Key Point | Brief Description |

|---|---|

| Balance Transfers | Move high-interest debt to a new card with a 0% introductory APR to save on interest. |

| Card Selection | Evaluate credit score, APR period, balance transfer fees, and post-promotional rates. |

| Maximizing 0% APR | Prioritize aggressive repayment, avoid new purchases, and automate payments during the promotional period. |

| Holistic Approach | Combine balance transfers with budgeting, debt consolidation, and credit counseling for long-term success. |

Frequently Asked Questions About Debt Management and Balance Transfers

A balance transfer moves debt from high-interest credit cards to a new card, often with a 0% introductory APR. This eliminates interest payments for a set period, allowing more of your monthly payment to go directly towards the principal balance, thus reducing the overall cost and accelerating debt repayment.

Yes, most balance transfer cards charge a fee, typically ranging from 3% to 5% of the amount transferred. It’s crucial to factor this fee into your calculations to ensure the interest savings during the promotional period outweigh this initial cost, making the transfer worthwhile.

The length of 0% APR introductory periods varies by card and issuer, typically ranging from 6 to 21 months. It’s vital to choose a card with a period long enough for you to realistically pay down a significant portion, or all, of your transferred debt.

If you don’t pay off the balance before the promotional APR expires, the remaining balance will revert to the card’s standard, higher interest rate. This can quickly negate any savings you achieved during the introductory period, so a clear repayment plan is essential.

Applying for a new card results in a hard inquiry, which can temporarily lower your score. However, successfully managing the transferred debt and reducing your credit utilization can positively impact your score in the long run. Strategic use is key to improving credit health.

Conclusion

Navigating credit card debt in 2025 requires informed decisions and strategic planning. Balance transfers stand out as a highly effective tool within comprehensive debt management strategies, offering a tangible pathway to significantly reduce interest payments and accelerate debt repayment. By carefully selecting the right offer, diligently adhering to a repayment plan, and avoiding common pitfalls, individuals can seize control of their financial future. Remember, a balance transfer is often most effective when integrated into a broader approach that includes budgeting, responsible spending, and continuous financial education, ultimately leading to lasting financial freedom and peace of mind.